this article is talking about inventory calculation

Inventory Closing

Why You should Closed the Inventory

All Ax Inventory transaction, recorded the transaction in average by default, so if the company did not use average costing instead using FIFO/LIFO Costing, every period they must recalculate the inventory so the inventory cost will change to FIFO/LIFO before they doing the financial closing.

but in progress, the recalculation always start from the last closing inventory date, it means that if we do not closed the inventory, the recalculation will recalculate from old past period, for example, if the last inventory closing do on 2013, so recalculation starts calculate from early 2013.

while we do the recalculation, the current inventory transaction will also recalculate the Cost (COGS), and if the recalculation periods start from past year, it will take an ax slow while doing inventory transactions such as receive good, picking list, packing slip and not forgot to mention, sales invoice.

Just I said pre-article, as default, AX set the inventory transaction cost by average, so if we did not recalculate as FIFO or LIFO, it will be problem when we do the financial closing, it means, the COGS value will be average. by example, “A” entity has FIFO costing standard, while they did not do the recalculation, problems will occurred when they closed the financial, and also while the sales invoiced done after the financial closing, ax will have an error by default because the inventory cost before and after financial closing is not identical.

Requirement to do inventory Closing

- You should clean up all pending inventory transaction, such as, transfer order, counting journal, receipt product (AP), picking list, packing slip, sales return

- You should notices that, all transaction using “session date” must not execute after the inventory closing, so, finished all the pending transaction before you do inventory closing

- You must closed (on hold minimum, all the financial ledger) after you do the inventory closing, it means, we cannot input “session date” transaction

- Before you do the inventory closing, Do the Recalculation first. this is the important requirement, do not closing the inventory before you do the recalculation.

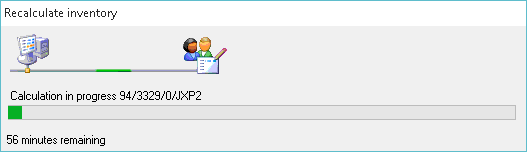

- Do the recalculation and inventory closing not in peak hours, do it when all the employees go home, the recalculation and inventory closing cannot be execute if an inventory transactions occurs, and when it happen, we should resume the recalculation

So, how if “we already closed the inventory and by then some transactions forgot to input?”

the Inventory Closing must be cancelled, and must be continued cancel. example, if we already closing june, july and august, and we must input the transaction in june, we must cancel the inventory closing in august, july, june, input the transaction, recalculate from june, closing june, recalculate july, closing june, recalculate august, closing august. sigh

Note: closing inventory must be done in end periode each month, by example, 30 june, 31 july, 31 august etc

so, we suggest that if we will do the inventory closing, ask the user for inventory transaction, all input by user or not. were they forgetting something or not.

How to do the Inventory Closing

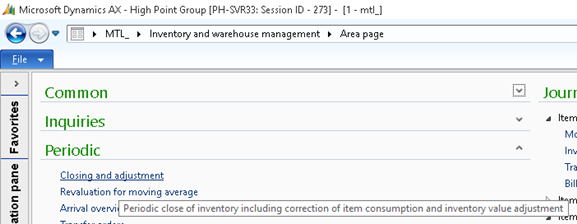

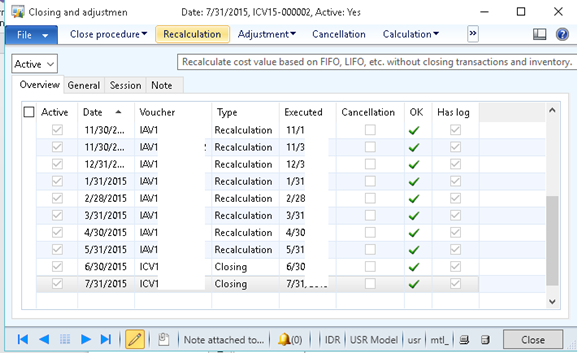

see the picture below, go to inventory and warehouse management –> Periodic –> Closing and adjustment

Step 1 : recalculation

run the recalculation, make sure that there were no pending transaction in current periods,

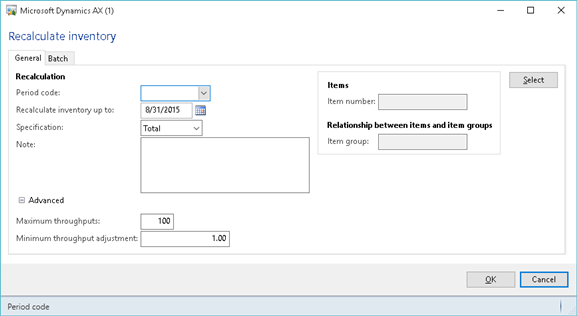

Entry the periods, recalculate until date, (all recalculate must start from latest inventory closing date),

Note: we can recalculate on specific item by press “select” button on on right top

Press “OK” button to start recalculate

Jika sudah selesai, lakukan

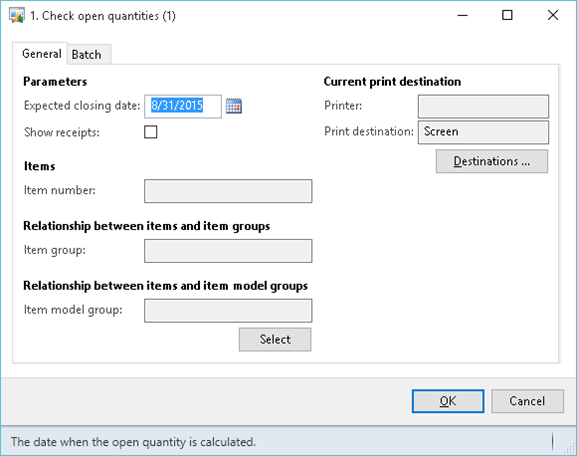

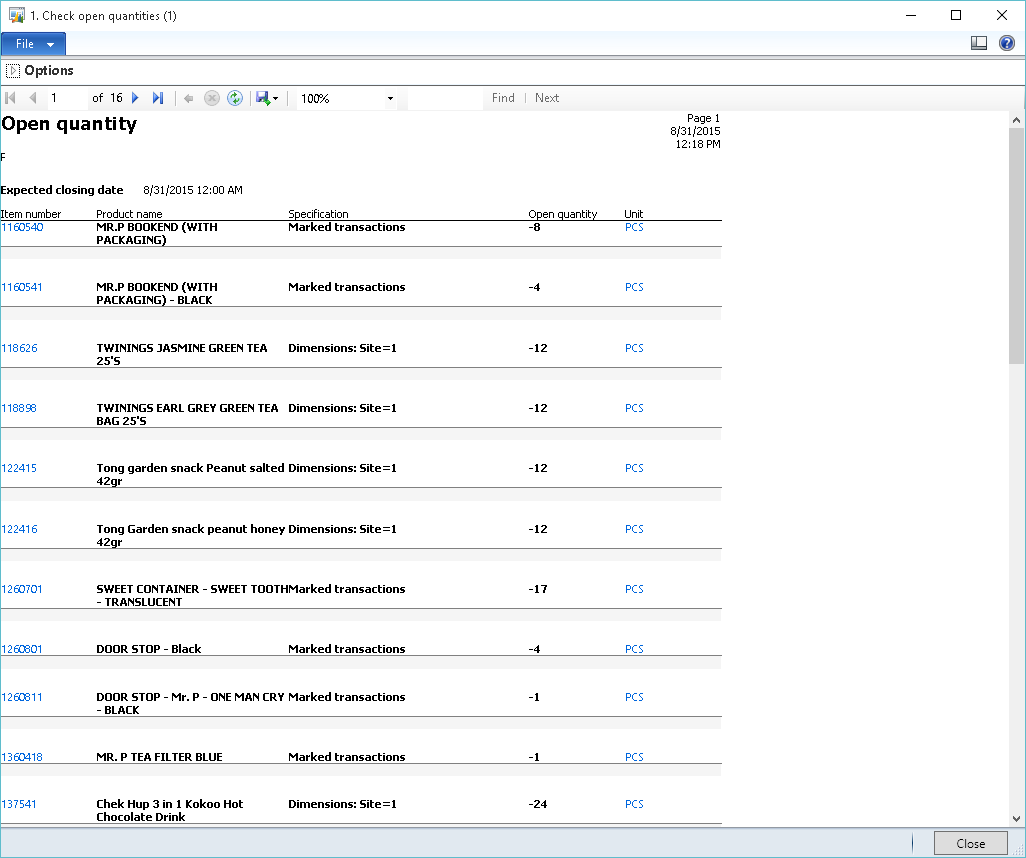

Step 2 : Check Open Quantity

Procedure “Check Open Quantity” use for checking on inventory that were marked or minus quantity because of pending transactions, if we see the inventory that were marked or minus, we must pending this step and finished all the pending transaction, and recalculate again.

Closed Procedure -> 1. Check Open Quantity,

see on the picture below,

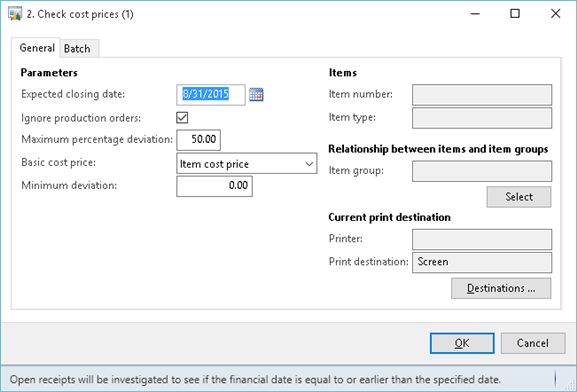

Step 3 : Check Cost Price

“Check cost Price” will show us the cost price on inventory that already calculate (before posting)

Closed Procedure -> 2. Check Cost Price

If all 1,2,3 step already passed, we can do the final step that is CLOSED.

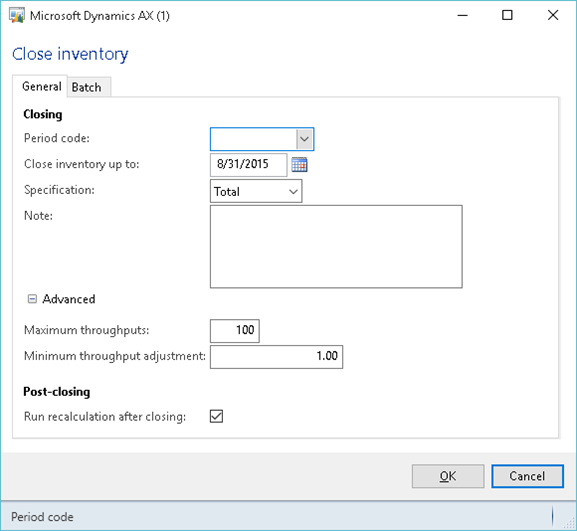

Final Step : Closed, Inventory Closing

Closed Procedure –> Closed

you can run the next periods recalculation by checking the “Run Recalculation after closing”, it recalculate the next periods starting from “close inventory up to” date

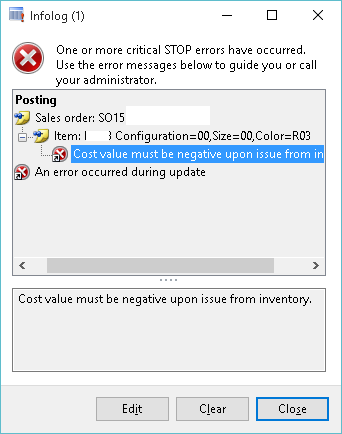

Case might be happens in Inventory Closing

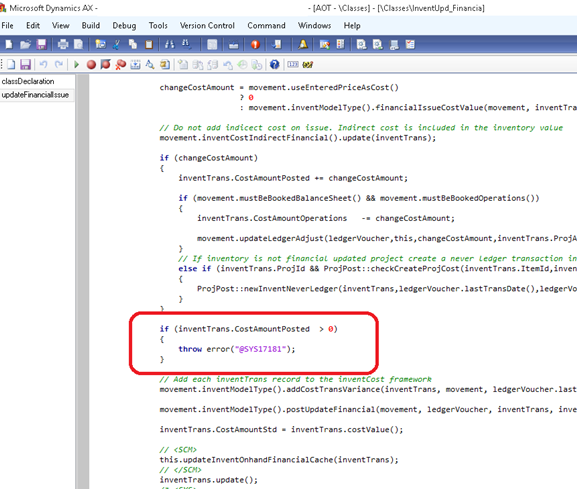

while you do the inventory closing not in correct time, sometimes user will receive an error message about cost value when they do a transfer order, sales invoice, etc (see the picture below)

the problem is, the cost value in current transaction was unmatched than cost value in financial amount (inventtrans)

see in aot -> \Classes\InventUpd_Financial, function updateFinancialIssue

inventtrans costamountposted is higher than costamountadjust, it means user forget to recalculate the inventory before they closed the inventory

these are the solution for this case:

- do the normal procedure

- cancel the inventory closing

- recalculate the periods

- closing the inventory

- NOTE: Sometimes, user do not use this method because it will change their financial closing (if they already closed the financial)

- (AX developer Only)

- Go to AOT, go to \Classes\InventUpd_Financial, function updateFinancialIssue, by pass the debug validation

- Generate sales invoice by AX developer

- (AX developer Only),

- go to AOT, open table inventtrans, find the records items, replace the costamountadjustment by costamountposted.

- ask ax user to create the sales invoice,

- go to AOT, open table inventtrans, find the records items, replace the costamountadjustment by original value.

-RF-